Customer Centric

Claims Management

Assessing. Defining. Transforming.

Claims management as a key driver of transformation

Claims management is one of the most important and at the same time most challenging areas of the insurance industry. This is because efficient and customer-centric claims management has a significant impact on customer satisfaction and is therefore a decisive competitive factor.

Increased customer needs and new technologies - coupled with exponentially increasing data availability and demographic change - bring new challenges and opportunities for claims management.

By expanding existing networks into value-driven ecosystems and building platform-driven business models beyond claims, claims management is becoming a key driver of transformation. Networking and cross-industry collaboration are increasingly becoming the premise for sustainable business success in the claims sector.

With a well thought-out process model, insurers can proactively shape this transformation and thus sustainably optimize their claims processes. We support you in offering your customers a unique, digitalized and empathetic customer journey at the “moment of truth”.

Do you have any questions?

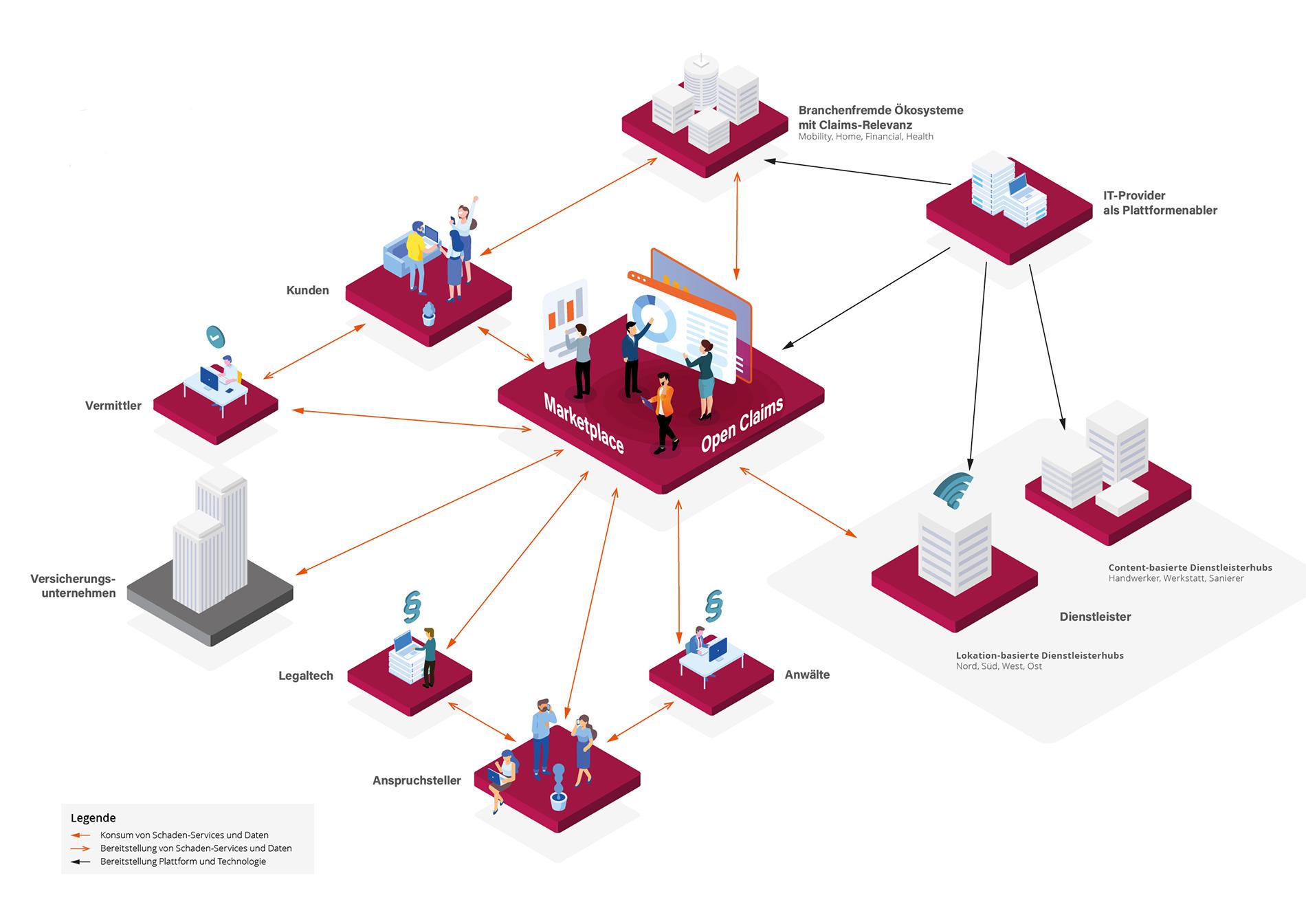

The claims market of the future: an overview

Answers to the three most important questions

Current trends give decisive indications that in future there will be a central marketplace for the provision and consumption of claims data, claims services and transactions. The first steps in this direction can already be observed today: Many players (insurers, service providers, IT providers) are already trying to establish corresponding marketplaces with specific focuses (B2B, B2C, B2B2C).

Insurers are faced with the task of strategically positioning themselves in this dynamic environment and building a future-proof claims business model.

The strategic question is which parts of the claims value chain are strategic assets for insurers and which claims transactions can be sourced. How does this affect its combined ratio and the customer experience of its customers? The range of options for actively participating in the future claims market in different segments or using services from partners is greater than ever. This is both an opportunity and a challenge.

- This marketplace will be characterized by the fact that it will be open and usable for all players. This includes not only insurers, claims and IT service providers, but also customers and claimants and, above all, new participants in ecosystems outside the industry.

- In general, there will be various forms of this open claims platform, focusing on specific lines of business, functionalities or niche offerings, for example. Development will not be ad hoc, but rather gradual. In the end, there will be a consolidated market environment that contains monopoly or oligopoly-like offers for open claims marketplaces for those involved in claims.

- In the future, players with the relevant expertise will be linked directly or indirectly to central open claims platforms. Depending on their strategic orientation, these can be insurers themselves or specialized network partners. They can consume these solutions in the form of services.

- Existing platforms and interfaces are integrated into these and supplemented by other providers. As a result, all claims management activities will converge via open and standardized interfaces. The required standard functionalities, such as transaction monitoring or data management, will be provided by the marketplace itself.

- The operating model claims of insurers is made more flexible: Simpler onboarding and offboarding of claims services makes it possible to react faster and more precisely to changing conditions in the interests of the customer.

- Innovative claims services are just a few clicks away: current innovation restrictions, in particular organizational and technical bottlenecks in insurance companies, will no longer play a role.

- Claims innovations will be democratized: The marketplace will be open and usable for all players. This includes not only insurers, claims and IT service providers, but also customers and claimants and, above all, new participants in ecosystems outside the industry.

- Simplification of communication between the parties involved in claims: All claims management activities come together via open and standardized interfaces.

- No lengthy administrative work in collaboration with partners: Consumers can focus fully on the innovative claims services and their added value for their claims performance right from the start.

“The fulfillment of the value proposition in the event of a claim by the insurer is the decisive point of contact with the customer. However, real customer enthusiasm in claims management only arises through the speed, simplicity and transparency of claims settlement.”

Dr. Andrea van Aubel

Member of the board at msg

Our Commitment

Assessing. Defining. Transforming. For us, advice comes first - and then the solution.

Optimization of your claims reporting route or a comprehensive customer-centric transformation of your operating model claims? We develop customer journeys and solution concepts for a claims ecosystem that is constantly changing. We not only design the digital transformation of your claims management, from new technology to innovative business models: we also implement these individually for you with claims solutions tailored to your situation.

Your top action points as a claims manager

Personalize your claims operation

through data-based customer insights and AI-supported next best actions

Make your claims operations more flexible

through service-oriented sourcing and automated light-dark process control

Open your claims operation

via open and standardized interfaces for new partners and business models

5 reasons for your claims management transformation with msg

1. Functioning claims customer journeys that delight your customers and reduce your claims costs.

2. Personalized, proactive claims settlement that takes your customers' needs into account and simplifies the lives of your claims staff.

3. A flexible claims operation that can seize opportunities and respond quickly to new influences

4. An open claims ecosystem that paves the way for new business models.

5. Intelligent claims automation that combines customer expectations and process efficiency.

Our references

How can we support you with your claims management service?

Feel free to contact us!

Andre Neumann

Head of Claims Management Insurance