MARZIPAN AI

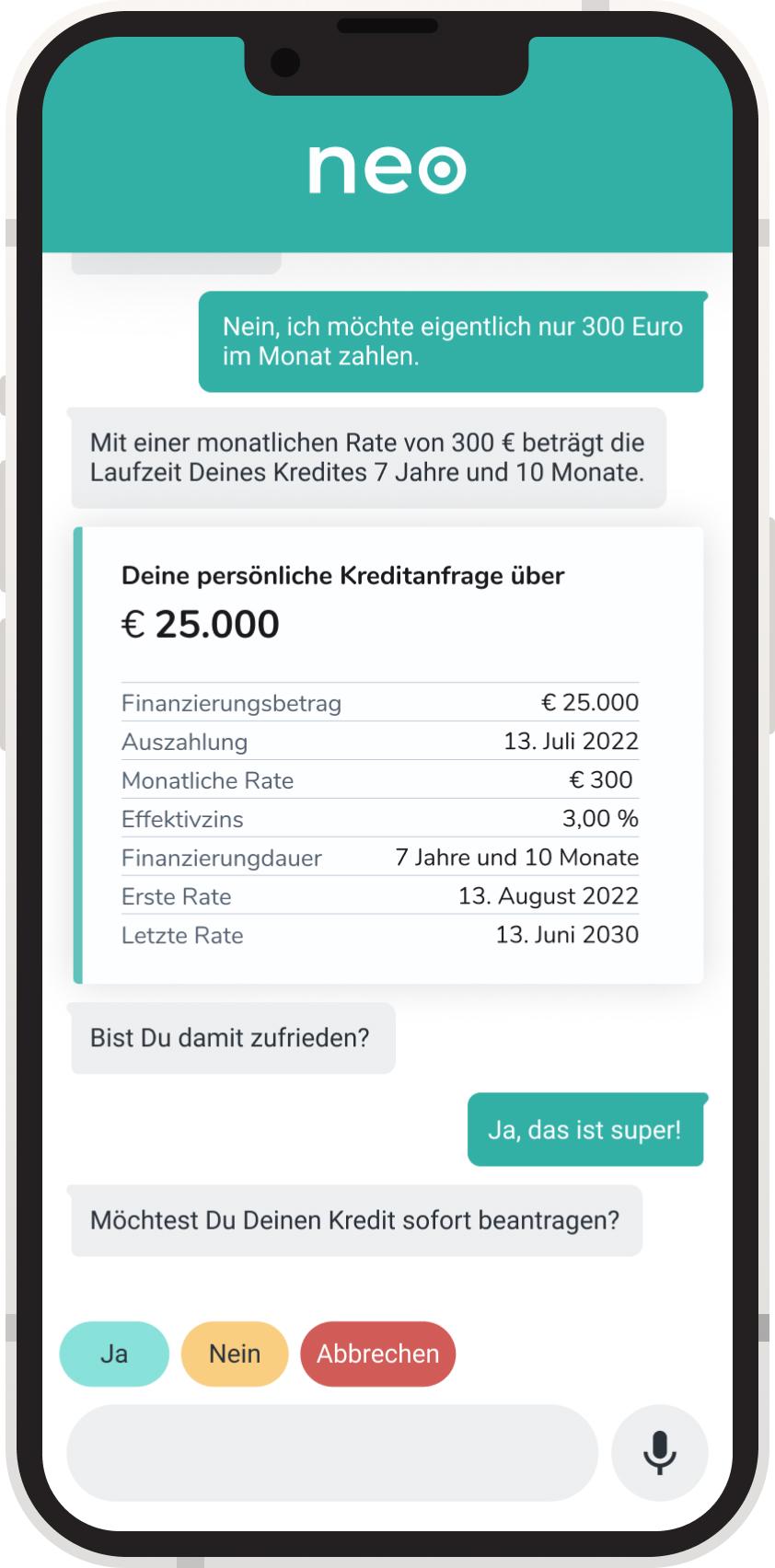

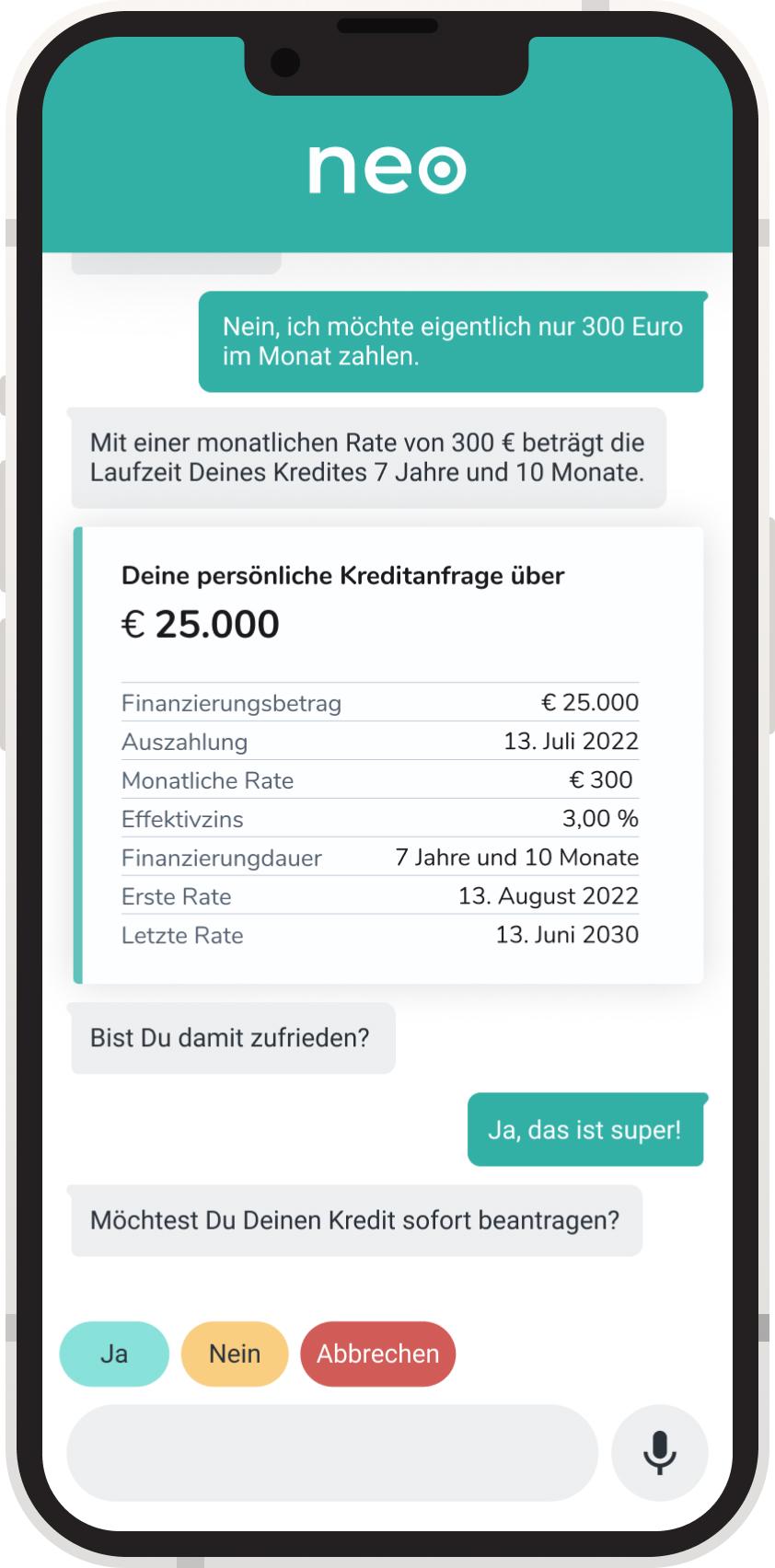

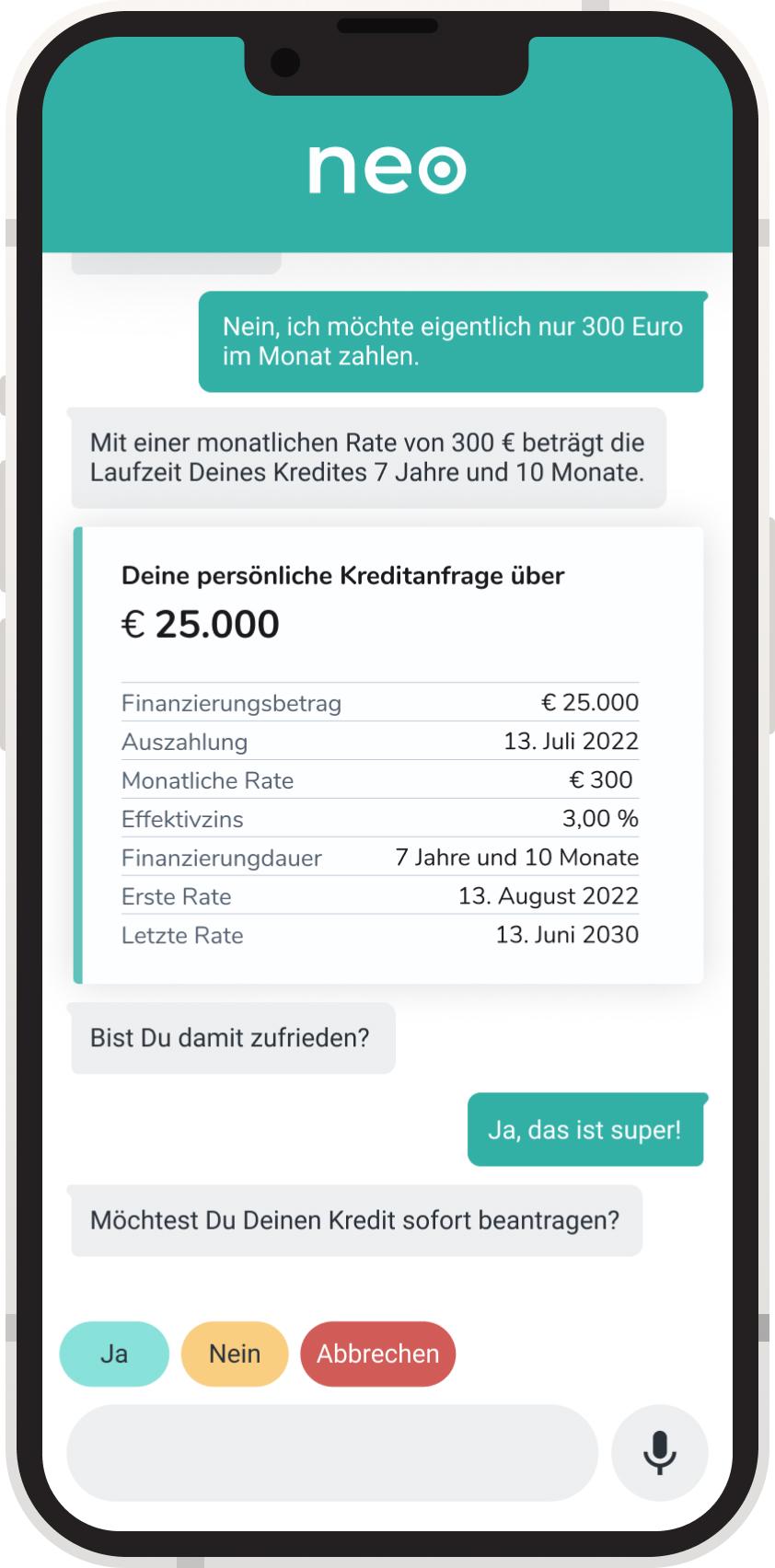

"Hi I want to buy an e-bike for 7,500 euros. I want to have repaid the loan by the end of my BA studies in 2025. I would like to get the e-bike as soon as possible."

These few pieces of information are enough for the digital assistant MARZIPAN KAI to make a binding loan calculation. KAI is smart, available 24/7 and successfully guides customers through the application jungle – all the way to loan approval. Media and system discontinuities? Foreign words to KAI.

Accessible voice control becomes a user experience

With KAI, the MARZIPAN software product line – together with the msg subsidiary Neohelden – is entering the world of voice-controlled loan management. Neohelden's product Neo contributes a modern solution for digital assistance services to KAI.

Our goals in the joint development of MARZIPAN KAI

Customer proximity through intuitive loan calculation

KAI is changing banking by making it easy to deal with incomprehensible and non-transparent financial products. The magic word is Natural Language Understanding (NLU). It enables our assistant to immediately understand queries from customers and to answer them in complete sentences.

Natural language is understood to such a degree that KAI can differentiate between different forms of loans, can recognize amounts up to the cent and can interpret colloquial language. We have trained KAI to understand even complex texts: Relevant calculation bases are extracted from the conversation and immediately translated into a loan proposals.

In addition to operation via voice control, KAI also offers fast entry of the customer's request via keyboard or selection fields. With its diverse communication channels, KAI is able to calculate and illustrate loans for everybody – especially for people with impairments. In this sense, we contribute to making banking easy for everyone.

Financial mathematical complexity – reduced to a minimum

With KAI, bank customers configure their loans themselves and bring them to completion in a short time. All KAI needs is the amount, the term and the start date of the financing – packaged in one sentence or as part of an open dialog, guided by KAI.

All the information provided by KAI is plausible and understandable – using the MARZIPAN calculation service, KAI always proposes the loan that matches the application. And never tires of providing further variants. Is the customer interested in another term or loan amount? Or do they only need the money in another two weeks? KAI adjusts the calculation at lightning speed until all wishes and criteria are fulfilled. KAI guides you through the entire loan granting procedure and rounds off the end-to-end process by communicating digitally with the customer.

In doing so, KAI creates the bridges between customers and consultants and writes consolidated data directly into the bank’s internal CRM system. Integrated data management and micro services enable the digital assistant

Quick onboarding through technical excellence

KAI can be quickly integrated and actively assists your team in only a couple of weeks.

As cloud solution, KAI can be integrated into almost any system environment and into all existing bank processes using intelligent interfaces. The assistant can be easily placed on your own website, a platform or in the app store and provides support and customer management in a few steps.

Thanks to our white labeling technology, KAI appears in the corporate design of the respective credit institution or purpose of use. This makes the digital assistant a value-added complement to existing customer platforms and tools.

Would you like to learn more about the diverse application areas?

Please complete the form to contact us. We will get in touch with you as soon as possible.